As Tax Deadline Day 2015 Approaches, Tax Filing Becomes Ordeal for Same-Sex Couples

While filing tax returns is a necessary yearly chore for most Americans, Tax Day is an accounting calvary for many married same-sex couples in states that do not recognize such union and disallow them from filing jointly.

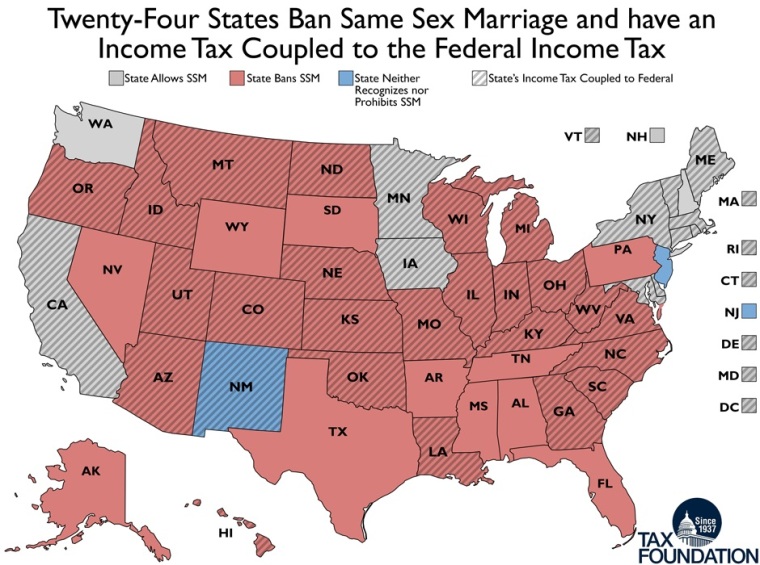

While straight couples can just copy numbers from one form to another, same-sex couples that live in the 13 states that have yet to join the bandwagon of the 37 recognizing such marriages have to deal with untangling their finances and filing separate returns, FoxBusiness wrote on Saturday.

And they have to hurry as the filing deadline, Wednesday, April 15, is just around the corner.

"We're adults, we're contributing to the welfare of society and yet, here's this one thing that just reaches up every year and kind of slaps us in the face," said Brian Wilbert, an Episcopal priest from Ohio who married his husband, Yorki Encalada, three years ago in upstate New York. Ohio, which does not recognize same-sex marriages, requires couples like Wilbert and Encalada to file their state tax returns like they did before getting married.

"It may not be the most burning thing," said Wilbert. "But as we think about equality and marriage equality, this is an important thing because it's part of what couples do."

"So you have this one return that would normally give you the numbers to do your state tax return, but instead you have to split all your incomes again and pretend like you're not married," said Deb L. Kinney, a partner at the law firm of Johnston, Kinney & Zulaica in San Francisco.

"Your health care benefits will be taxed differently and your credits will be different. Your interest deduction could be different, and then you have to go through the allocation on each return," Kinney said. "It's much more expensive and cumbersome."

After the Supreme Court struck down part of the federal Defense of Marriage Act in 2013, the Internal Revenue Service announced that it would recognize same-sex marriages for federal tax purposes even if those couples live in one of those 13 states.

However, in Georgia, Kentucky, Louisiana, Michigan, and Nebraska, same-sex couples still have to fill out multiple federal tax returns or "dummy returns," so they can come up with the proper figures for their state returns. First, they have to complete a joint federal income tax return, which will be filed with the I.R.S. Next, each of them will have to fill out a separate federal return as if the filer is single. Information from these returns is used to fill out state income tax returns, which are filed as if each was single.

"You have to literally make out five returns and file three," said Scott Squillace, a tax lawyer who wrote a legal guide for gay and lesbian couples called, "Whether To Wed."

"If someone with a joint bank account writes a check for a charitable donation, the question is, do you split it 50-50? Or is it that person's deduction when they file a single return?" said Arianne Plasencia, a tax lawyer at the Carlton Fields law firm in Miami.

In Kansas, North Dakota, and Ohio, same-sex couples must fill out worksheets to unravel their finances. The form provided in Ohio has 31 lines, but most couples do not have to complete all lines.

"There is no way that I, as a Joe Q. Public, who happens to be gay and in a same-gender marriage, would figure out how to fill this form out," said Wilbert. "I mean, it's just impossible."

He added that he had to hire an accountant and get an extension, which are firsts.

In South Dakota, there is no state income tax so the issue is moot. In Arkansas and Mississippi, information from federal returns is not used on state income tax forms.

In Alabama, same-sex couples divide the earnings and taxes they report on their federal returns, based on each spouses' share of their combined income. In Missouri, same-sex unions are not recognized but Gov. Jay Nixon issued an executive order requiring gay and lesbian couples to simply file joint state tax returns if they file a joint federal return.

The number of states recognizing same-sex unions grew to 37, plus the District of Columbia, after the Supreme Court struck down the federal Defense of Marriage Act and ruled that married same-sex couples can access federal benefits.

Those who oppose same-sex marriage want the court to return the issue back to the states, as recognition of such spread through court orders instead of the ballot box.

"It's not about the rights of a handful of people who want to change the institution of marriage," said Phil Burress of Citizens for Community Values, an Ohio group. "It's about the will of the people."

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal Archaeology discovery: Medieval Christian prayer beads found on Holy Island

Archaeology discovery: Medieval Christian prayer beads found on Holy Island Presbyterian Church in America votes to leave National Association of Evangelicals

Presbyterian Church in America votes to leave National Association of Evangelicals Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday

Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war

Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war Islamic State kills 20 Nigerian Christians as revenge for US airstrike

Islamic State kills 20 Nigerian Christians as revenge for US airstrike Man who served 33 years in prison for murder leads inmates to Christ

Man who served 33 years in prison for murder leads inmates to Christ

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message 'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen

'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen Iran sentences Christian man to 10 years in prison for hosting house church worship gathering

Iran sentences Christian man to 10 years in prison for hosting house church worship gathering French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals

French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals ‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians

‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide'

Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide' Church holds service for first time after ISIS desecrated it 8 years ago

Church holds service for first time after ISIS desecrated it 8 years ago Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper

Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name

Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name